Democrats oppose the House Republicans’ bill, the American Relief Act of 2025, a 389-page reconciliation tax bill introduced by House Republicans through the Ways and Means Committee on May 12, 2025, under the FY 2025 budget resolution (H.Con.Res.14), often referred to by the media as “The 2025 GOP Tax Bill” or part of the “One Big Beautiful Bill.”

The bill includes:

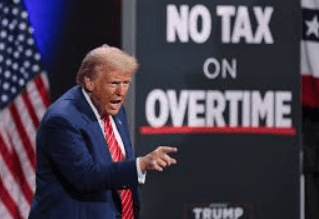

No Tax on Overtime Pay and Tips: Eliminates federal income taxes on overtime pay for eligible workers and tips for service industry employees, such as restaurant and hospitality workers. This increases take-home pay for working-class Americans, directly supporting their financial well-being.

Extension of the 2017 Tax Cuts and Jobs Act (TCJA): Extends the TCJA, which increased after-tax income for 65% of households by 1–2% and drove 2.5% annual GDP growth from 2017 to 2019. By preventing tax hikes scheduled for 2025, it maintains lower individual and corporate tax rates, benefiting millions of families and businesses.

Elimination of Tax on Car-Loan Interest: Removes taxes on car-loan interest, reducing vehicle ownership costs for middle-class borrowers, particularly in regions where cars are essential for work.

Increased State and Local Tax (SALT) Deduction: Raises the SALT deduction cap from $10,000 to $30,000 for households earning under $400,000, providing tax relief to middle-class homeowners in high-tax states like New York and California.

Support for Small Businesses: The bill extends the TCJA’s 20% pass-through deduction (Section 199A) for small businesses, potentially increasing it to 23%, fostering entrepreneurship and job creation by lowering taxes for approximately 26 million businesses and potentially creating 1 million jobs. It also provides permanent 100% bonus depreciation for equipment costs and simplifies tax compliance with higher expensing limits and standard deductions. These measures enhance cash flow, encourage investment, and support small business growth.

Economic Growth and Job Creation: Delivers $4.5 trillion in tax cuts over 10 years, as directed by H.Con.Res. 14, to stimulate investment and jobs. The TCJA’s precedent of boosting corporate investment suggests these cuts will drive economic activity, benefiting workers across income levels.

“MAGA” Savings Account: Establishes the Money Account for Growth and Advancement (MAGA) for children under 8, providing a $1,000 government deposit and allowing up to $5,000 in annual tax-free parental contributions, locked until age 18 for wealth-building.